deadline to pay mississippi state taxes

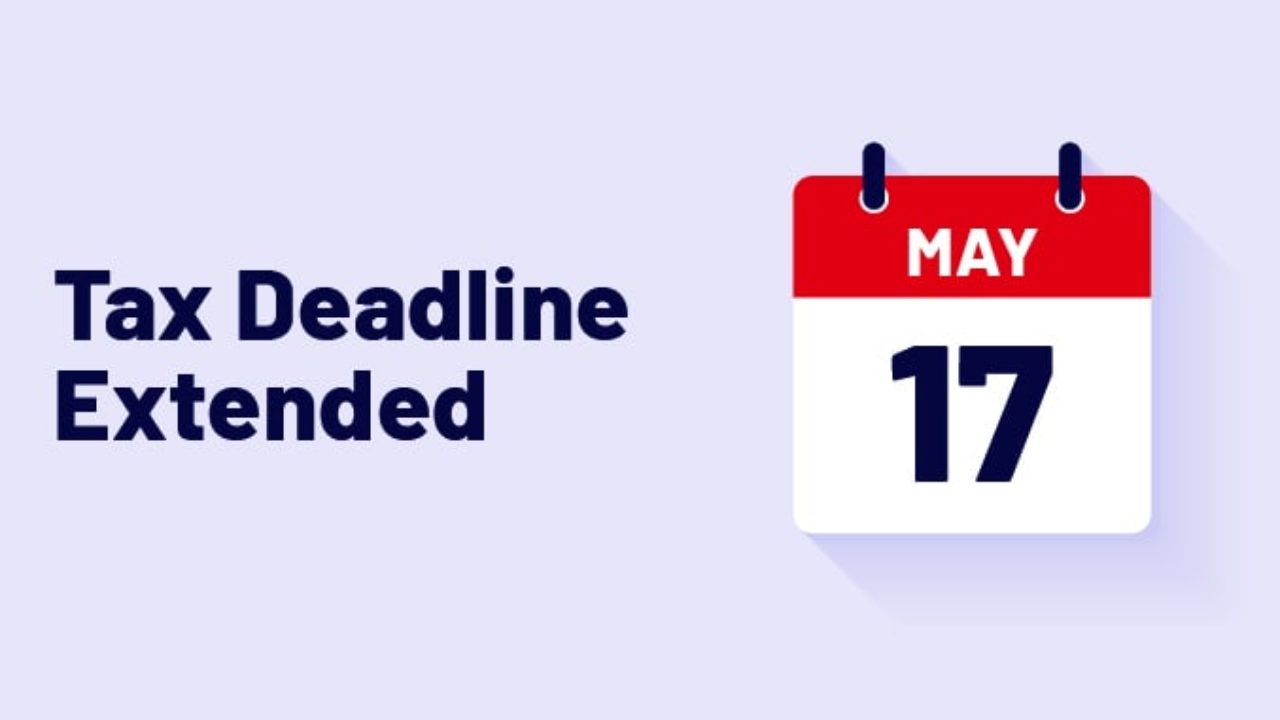

The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by winter storms in February. Since the due date is now May 1 2020 the 10 increase in assessment penalty for failure to provide to Assessor will also be extended to May 1 2020.

Federal Income Tax Deadline In 2022 Smartasset

Pay by credit card or.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. Box 23050 Jackson MS 39225-3050. A Mississippi personal extension will extend your filing deadline by the same amount of time as the Federal tax extension IRS Form 4868. Mississippi offers a 6-month extension which moves the individual filing deadline from April 15 to October 15.

States set their own filing deadlines and Mississippis is still April 15th as of this reporting. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. For those taxpayers who are unable to file electronically pre-addressed sales tax forms are mailed annually.

They will be due on May 1 2020. Click here to get more information. Tax penalties might apply if you owe taxes and you do not file something extension or return by April 18 2022 state deadlines may vary.

Extended Deadline with Mississippi Tax Extension. Pay by credit card or. Keep your post office receipt and ensure it.

Find IRS or Federal Tax Return deadline details. The penalty imposed for failure is based on the amount shown as tax on the return. This website provides information about the various taxes administered access to online filing and forms.

Even if you cant pay on time you should e-File a return or extension on time. The quarterly due dates are listed below. The 2021 mississippi state income tax return forms for tax year 2021 jan.

Counties in mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. The only exception is if. 3rd Quarter Due October 31st.

January 31 2022 for Mississippi State Taxes withheld. Real and. Taxpayers are requested to file returns electronically.

4th Quarter Due January 31st. MS individual income tax returns are due by April 15 in most years or by the 15th day of the 4th month following the end of the taxable year for fiscal year filers. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

The Department of Revenue is responsible for titling. In 2020 Mississippi did extend its filing to July 15th along with the federal deadline. Welcome to The Mississippi Department of Revenue.

Federal income taxes for tax year 2021 are due April 18 2022. Late payment penalty and interest apply to any unpaid tax after April 15. 2020 hurricane ida filing extension.

2nd Quarter Due July 31st. Simplify Mississippi sales tax compliance. This change in the federal filing deadline by the IRS does not mean Mississippians will get a similar reprieve from filing their state taxes.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. 1st Quarter Due April 30th. A handful of states have a later due date April 30 2022 for example.

An instructional video is available on TAP. The penalty for failure to file a return is imposed after Oct 15 2022. Deadline to File Mississippi Filing Taxes.

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. Information on Available Tax Credits. Mississippi Filing Due Date.

Most state income tax returns are due on that same day. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees.

If the any of the above dates fall on a weekend the due date will be on the next business day. You can make electronic payments for all tax types in TAP even if you file a paper return. In march the state moved the deadline to file and pay 2019 individual income tax to may 15 2020.

Form W2 - Wage and Tax Statements. Mississippi residents now have until May 15 2020 to file their state returns and pay any state tax they owe for 2019. Returns are due on or before the 20th day following the end of the reporting period.

All other income tax returns P. The due date for filing a MS tax return and submitting MS payments is April 18 2022. The last deadline after a tax extension or otherwise to eFile 2021 Tax Returns is October 15 October 17 2022.

Mississippi personal tax returns are due by the 15th day of the 4th month after the close of the tax year April 15 for calendar year taxpayers. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. While this year is a bit different for most Mississippi residents Tax Day is April 15 of each year matching up with the deadline for your federal return.

If you cannot file by that date you can get a Mississippi tax extension. Cre dit Card or E-Check Payments. For 2019 state taxes the state has extended the filing and payment deadline.

Mississippi Storm and Flooding Relief. The penalty is 5 per month not to exceed 25 in the aggregate. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code.

Mississippi State Tax H R Block

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

2022 State Tax Reform State Tax Relief Rebate Checks

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Overview Of Options For Taxpayers With Mississippi State Back Taxes

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippians Encouraged To File 2021 Federal State Taxes Early

2020 Tax Deadline Extension What You Need To Know Taxact

Mississippi State Tax Payment Plan Details

Mississippi Sales Tax Small Business Guide Truic

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog