nassau county property tax rate

Manufacturers on the cost price of products removed from inventory for their own use. The state has a 249 effective tax rate and the median home value is 335600 according to the report.

Mortgage Lingo A To Z Mortgage Banking Refinance Mortgage Mortgage Brokers

While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US.

. Nassau County uses a simple formula to calculate your property taxes. As compared with the state average of 123 property taxes can be much higher in the county than in the rest of the state. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value.

So a 1 mill increase in. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. Purchases of tangible personal property made in other states by persons or business entities for use in Florida.

Assessed Value AV x Tax Rate Dollar Amount of Taxes. 4 discount if paid in the month of November 3 discount if paid in the month of December 2 discount if paid in the month of January 1 discount if paid in the month of February Full amount if paid in the month of March no discount applied The full amount is due by March 31st and if not paid becomes delinquent on April 1st Payment Options. Municipalities None 6 sales and use tax applies to.

It was not possible to determine a countywide class-specific rate for Nassau County due to the complexity of taxing jurisdictions. Nassau County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent aware of your tax levy containing a higher figure than appropriate according to your propertys actual worth. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your property equals your property tax for county town and special district purposes. 516 571 3000 Phone 516 571 6164 Fax Get directions to the county offices For more details about taxes in Nassau County or to compare property tax rates across New York see the Nassau County property tax page.

The average tax rate in Nassau County is 179. Agendas Minutes Civil Service Exams Applications Licenses Forms and Permits. Average Property Tax Rate in Nassau County Based on latest data from the US Census Bureau.

For information or to RSVP call the Chamber of Commerce at 904-261-3248 or the local Janney office at 904-572-0265. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

In Nassau County the average tax rate is 224 according to SmartAsset. That means homeowners there pay about 8362 on a property valued at that amount. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

If you are contemplating moving there or just planning to invest in Nassau County property youll come to know whether Nassau County property tax statutes are well suited for you or youd prefer to search for an alternative locale. 20 at the Nassau County Chamber of Commerce 961687 Gateway Blvd Fernandina Beach. Rules of Procedure PDF Information for Property Owners.

We value your comments and suggestions. Is jewelry taxed in NY. Lookup SBL or Address.

Notes The rates are given in dollars per 1000 of full value rounded to the nearest tenth of a dollar. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000 and a median effective property tax rate of 179 of property value. What is the property tax rate in Nassau County NY.

State law has also chipped away at local millage rates. Depending on local municipalities the total tax rate can be as high as 8875. In dollar terms Westchester County has some of the highest property taxes not only in the state of New York but in the entire country.

What is the Nassau County Property Tax Rate. This means that a homeowner with a median-priced home in the county can expect to pay 8711 a year in property taxes. Nassau County 1 local option.

1 West St Mineola NY 11501-4813 Nassau County Contact Info. How to Challenge Your Assessment. Cocktails and Hors Doeuvres will be served.

What state has the lowest property taxes. In Nassau County the average tax rate is 224 according to SmartAsset. It is also linked to the Countys Geographic Information.

How do I calculate my Nassau County taxes. Sale of farm equipment is taxed at 3. How can we improve this page.

It might be helpful to recall that tax rates vary by municipality and the tax rate for one town might differ slightly from the next even if. Equipment items eg tool belts hard hats and sport bicycle and motorcycle helmetsSep 10 2019. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills.

What is the Nassau County Property Tax Rate. The complimentary presentation will be from 5-7 pm. What is Nassau County property tax.

Nassau County New York Property Tax Go To Different County 871100 Avg. Taxable purchases jewelry watches and similar accessories. Assessment Challenge Forms Instructions.

What is the Nassau County Property Tax Rate. Since 2008 Nassau Countys property tax rate went from 564 to 447. Nassau County Tax Lien Sale.

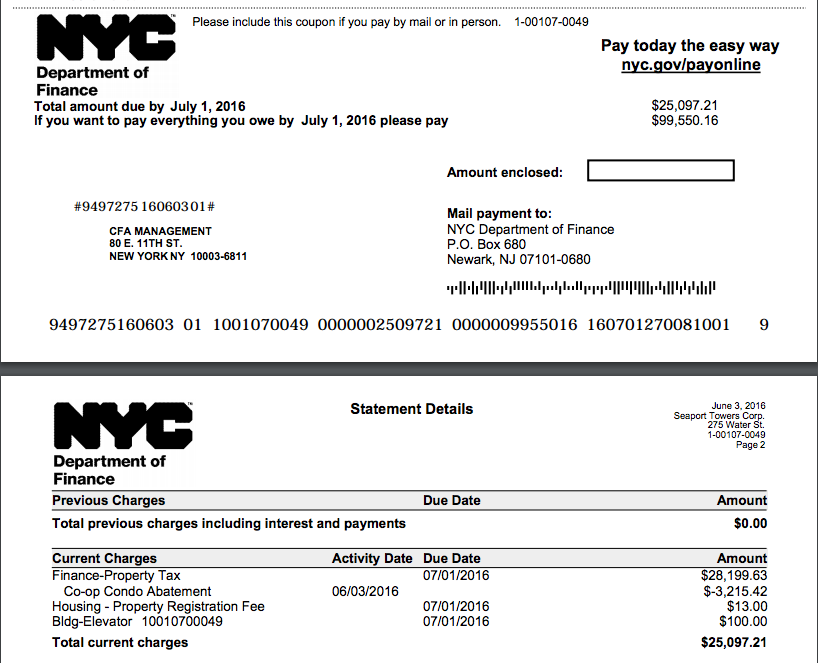

Nyc Tax Bill On Sale 55 Off Www Ingeniovirtual Com

New York Property Tax Calculator 2020 Empire Center For Public Policy

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

Nyc Tax Bill Store 58 Off Www Visitmontanejos Com

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Sorting Through The Property Tax Burden Tax Policy Center

Property Taxes In Nassau County Suffolk County

New York Property Tax Calculator Smartasset

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Property Taxes In Nassau County Suffolk County

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

All The Nassau County Property Tax Exemptions You Should Know About

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy